A mortgage schedule with taxes and insurance Excel template provides a comprehensive overview of your mortgage payments, including principal, interest, property taxes, and insurance costs. By breaking down each payment over the life of the loan, it allows you to track the total amount paid, alongside the remaining balance. This organized format enables you to plan your finances effectively, ensuring you remain on top of your mortgage obligations.

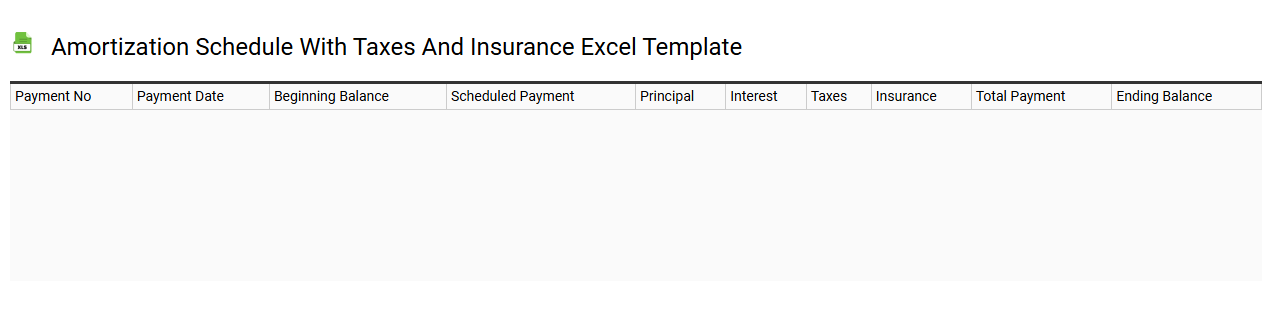

Amortization schedule with taxes and insurance Excel template

💾 Amortization schedule with taxes and insurance Excel template template .xls

An amortization schedule with taxes and insurance is a detailed breakdown of your loan payments over time, incorporating not just principal and interest, but also property taxes and homeowners insurance. Each row typically displays the payment number, payment date, principal amount, interest amount, cumulative interest, remaining balance, property tax portion, insurance portion, and total monthly payment. You can use an Excel template for this purpose, allowing easy calculations and adjustments as your loan terms or property-related expenses change. This tool helps track monthly obligations and can be expanded to include advanced features like variance analysis and scenario modeling for financial forecasting.

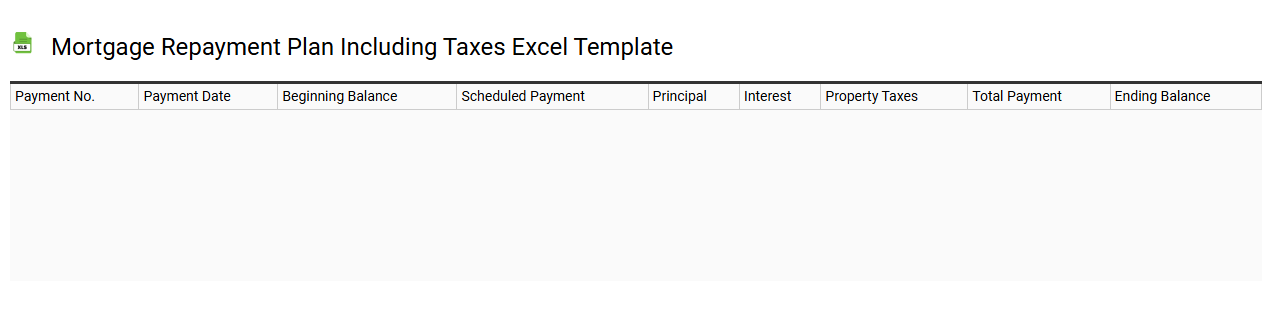

Mortgage repayment plan including taxes Excel template

💾 Mortgage repayment plan including taxes Excel template template .xls

A Mortgage repayment plan template in Excel is a structured tool designed to help you manage your mortgage payments effectively. This template typically includes various columns such as the loan amount, interest rate, loan term, monthly payment, and a breakdown of principal and interest. Taxes and insurance may also be integrated, giving a clear picture of your monthly financial obligations. With this template, you can track your progress over time, analyze potential extra payments, and explore options for refinancing or adjusting repayment schedules in the future.

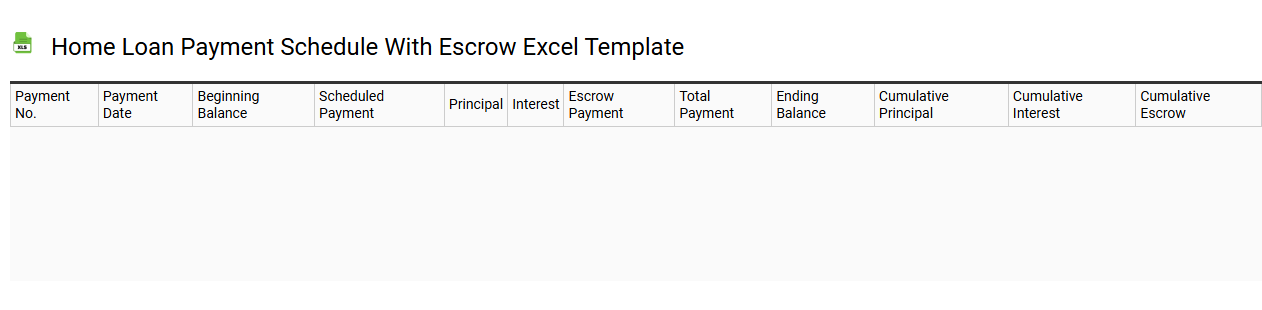

Home loan payment schedule with escrow Excel template

💾 Home loan payment schedule with escrow Excel template template .xls

A home loan payment schedule with escrow Excel template helps you manage mortgage payments effectively while accounting for property taxes and insurance. The template typically includes columns for payment dates, principal amounts, interest costs, escrow contributions, and total monthly payments. You can input your loan details, such as interest rate and loan term, which will automatically calculate amortization and payment breakdowns. This tool is useful not only for tracking regular payments but also for planning for future financial needs like refinancing or budgeting for home improvements.

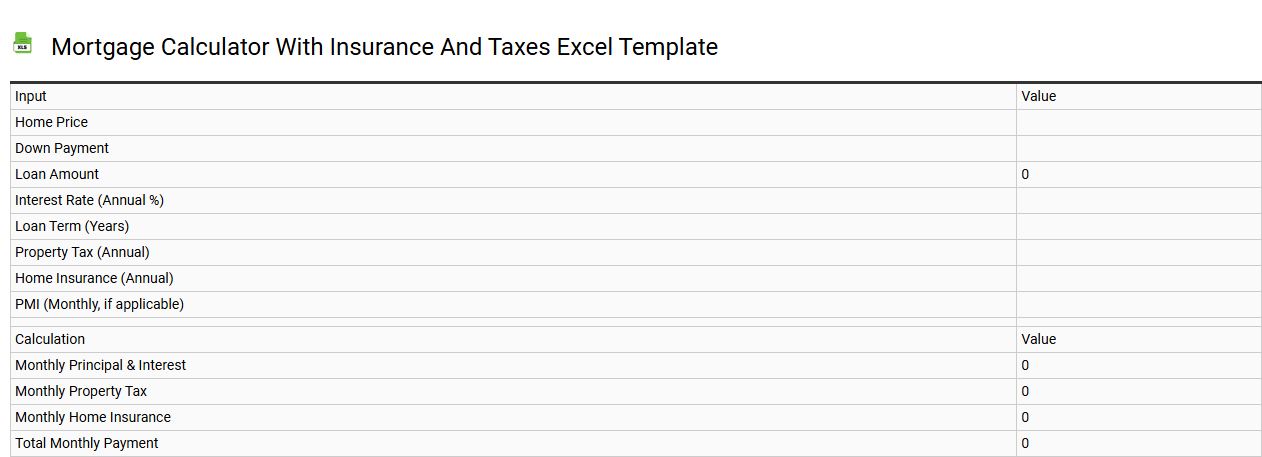

Mortgage calculator with insurance and taxes Excel template

💾 Mortgage calculator with insurance and taxes Excel template template .xls

A Mortgage Calculator with Insurance and Taxes Excel template is a powerful tool to help you manage your home financing effectively. This template allows you to input key financial information, such as loan amount, interest rate, loan term, property taxes, and insurance premiums. By automatically calculating monthly mortgage payments, including principal, interest, tax, and insurance components, you can gain a clearer understanding of your financial obligations. This resource not only simplifies budgeting but also provides insights for future financial planning, as you explore advanced variables like amortization schedules and editable inputs for variable interest rates.

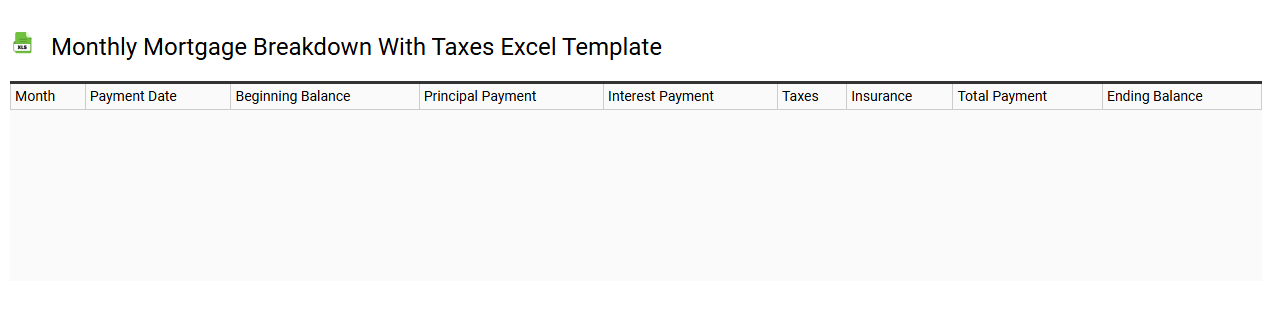

Monthly mortgage breakdown with taxes Excel template

💾 Monthly mortgage breakdown with taxes Excel template template .xls

A monthly mortgage breakdown with taxes Excel template provides a clear and organized display of your mortgage payments, including principal, interest, property taxes, and insurance. Each row breaks down the monthly payment into these key components, allowing you to easily track how much you pay towards your loan's principal versus what goes to interest and other fees. You can customize this template by inputting your mortgage details, such as the loan amount, interest rate, and term length, to generate a detailed amortization schedule. This template is essential for budgeting your finances and can be adjusted to explore advanced calculations related to refinancing or investment analysis.

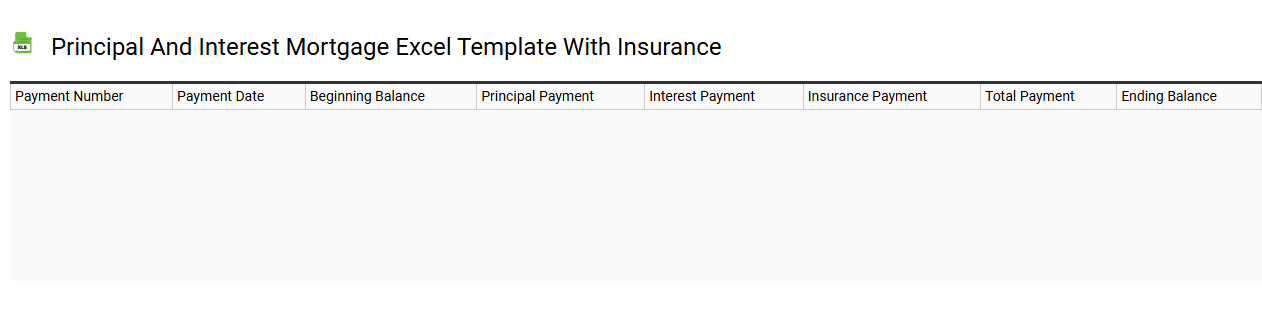

Principal and interest mortgage Excel template with insurance

💾 Principal and interest mortgage Excel template with insurance template .xls

A Principal and Interest mortgage Excel template with insurance provides a structured way to manage your mortgage payments. This template typically includes various fields to input the loan amount, interest rate, loan term, and insurance costs, allowing for an organized overview of monthly payment obligations. You can visualize how each payment is divided between principal and interest, along with additional insurance premiums, ensuring clarity on your financial commitments. By utilizing this template, you can easily adjust inputs to see how changes in interest rates or insurance affect your overall expenses and explore advanced options like amortization schedules and tax implications.

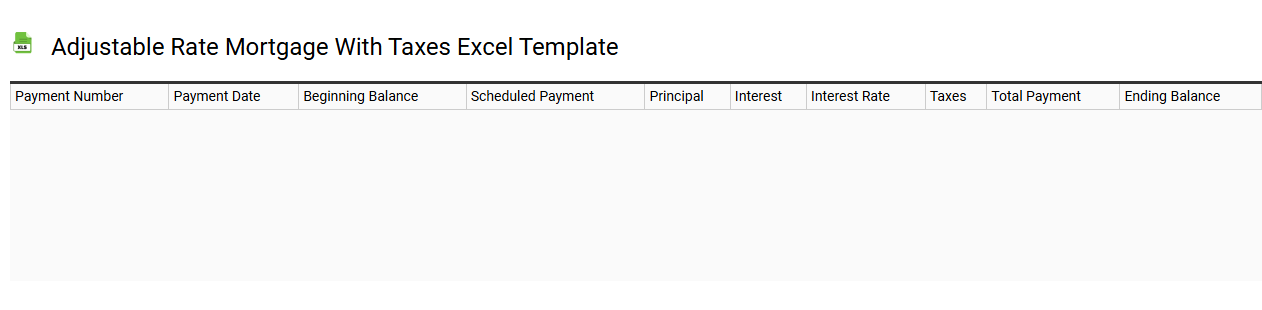

Adjustable rate mortgage with taxes Excel template

💾 Adjustable rate mortgage with taxes Excel template template .xls

An Adjustable Rate Mortgage (ARM) Excel template is a valuable financial tool designed to help you analyze and manage your mortgage payments tied to fluctuating interest rates. This spreadsheet typically includes fields for principal amounts, interest rate adjustments, term lengths, and property taxes, providing a comprehensive overview of your payment history and future obligations. You can customize scenarios based on potential interest rate changes, offering an insightful look into how your payments may evolve over time. Such a template can be especially useful for budget planning, and should your needs grow, you might explore advanced features like amortization schedules or tax impact projections.

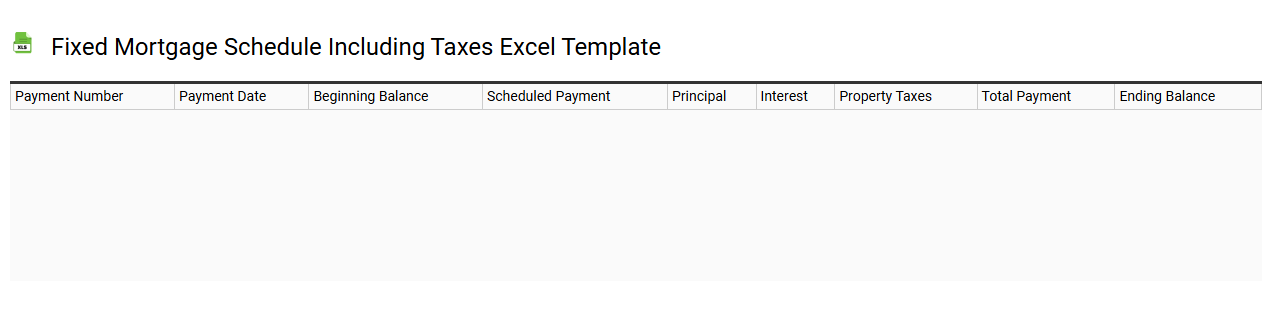

Fixed mortgage schedule including taxes Excel template

💾 Fixed mortgage schedule including taxes Excel template template .xls

A fixed mortgage schedule including taxes Excel template provides a detailed plan for managing your mortgage payments over time. This type of template includes sections for principal and interest payments, property taxes, and potentially insurance costs, allowing you to see the total monthly payment required. Clear columns for each payment period illustrate how your balance decreases with each installment, highlighting the effect of additional payments or changes in tax rates. You can customize the template to reflect your specific mortgage terms, and it serves as a foundational tool for understanding your financial obligations while also enabling you to project future needs related to refinancing or budgeting for expenses like home improvements.

Mortgage payment tracker with insurance Excel template

![]()

💾 Mortgage payment tracker with insurance Excel template template .xls

A Mortgage Payment Tracker with an insurance Excel template is a comprehensive tool designed to help you monitor your mortgage payments and associated insurance expenses efficiently. This tracker typically includes columns for the mortgage balance, interest rate, payment dates, and the amounts allocated towards principal and interest. It often integrates insurance costs, allowing you to keep tabs on homeowner's insurance premiums alongside your mortgage payments. You can customize formulas to project future payments, providing insights into your financial planning and potential equity growth. Basic usage of this template can help you manage your monthly obligations while offering further potential to analyze refinancing options or evaluate different mortgage strategies using advanced financial modeling techniques.

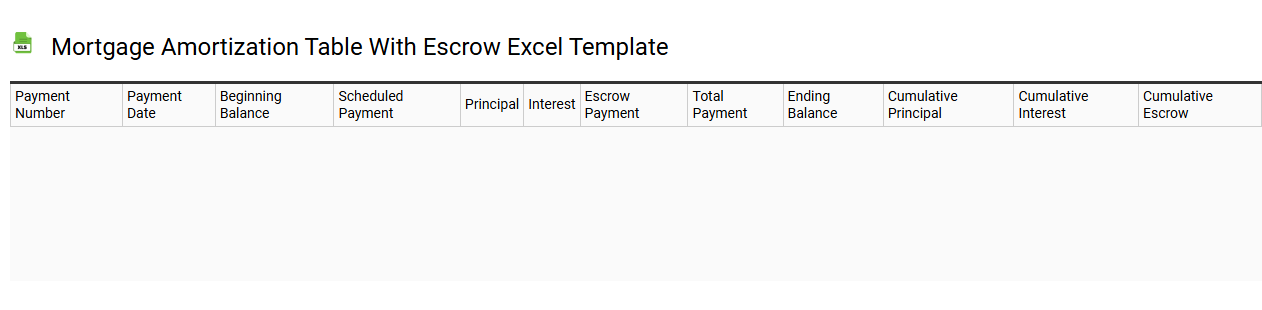

Mortgage amortization table with escrow Excel template

💾 Mortgage amortization table with escrow Excel template template .xls

A mortgage amortization table with escrow Excel template provides a detailed breakdown of your mortgage payments over time, including principal, interest, and escrow components. Each row typically represents a monthly payment, showing how much goes toward reducing the loan principal, how much is allocated for interest, and the portion set aside for property taxes and insurance within the escrow account. You'll find the remaining balance after each payment, giving a clear picture of your loan's progression toward full repayment. This template serves not only for tracking monthly obligations but also for projecting financial goals like refinancing or adjusting payment structures.