A mortgage overpayment tracker Excel template offers a straightforward way to monitor your extra payments towards a mortgage. This template allows you to input your payment dates, amounts, and remaining balance, providing a clear visual of your progress and savings on interest. With easy-to-use formulas, you can quickly calculate how much interest you'll save over the life of the loan, empowering you to make informed financial decisions.

Mortgage overpayment tracker Excel template free download

![]()

💾 Mortgage overpayment tracker Excel template free download template .xls

A Mortgage Overpayment Tracker Excel template is a useful financial tool designed to help homeowners monitor extra payments made toward their mortgage. This template allows you to input your mortgage details, including the principal amount, interest rate, and payment frequency. By tracking overpayments, you can visualize how much interest you save over time and potentially reduce the length of your mortgage term. This versatile tool caters to basic tracking needs while offering the potential for advanced functionalities, such as amortization schedule adjustments and early payoff calculators.

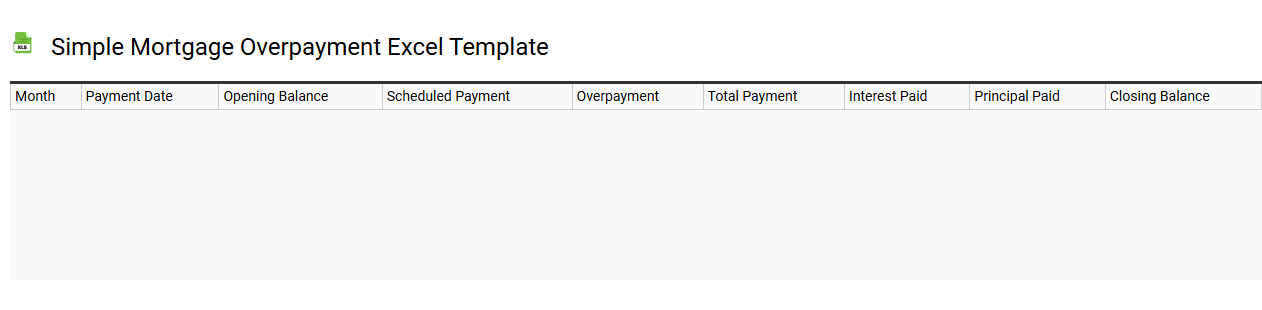

Simple mortgage overpayment Excel template

💾 Simple mortgage overpayment Excel template template .xls

A Simple Mortgage Overpayment Excel template is a financial tool designed to help you visualize how additional payments towards your mortgage can reduce the overall loan term and interest paid. This template typically includes input fields for your loan amount, interest rate, and the duration of your mortgage, along with options for extra monthly or yearly payments. It generates charts and calculations to show the potential savings in interest and the new payoff date, helping you make informed decisions about overpayments. By using this template, you can explore various overpayment scenarios to align with your financial goals, from basic strategies to more complex amortization schedules.

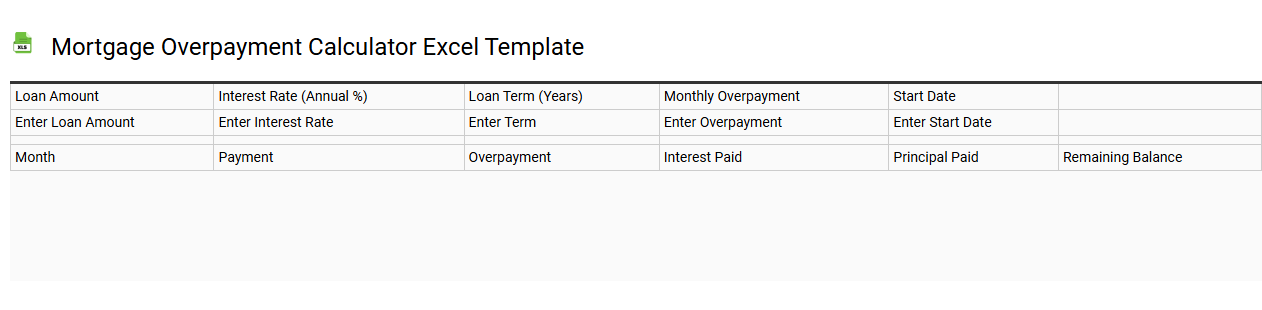

Mortgage overpayment calculator Excel template

💾 Mortgage overpayment calculator Excel template template .xls

A Mortgage overpayment calculator Excel template is a practical tool designed to help homeowners analyze the financial impact of making additional payments on their mortgage. This customizable spreadsheet allows you to input your current mortgage balance, interest rate, and repayment term, as well as any extra payment amounts. By doing so, you can easily visualize how overpaying on your mortgage can reduce the total interest paid and shorten the repayment period. You may also discover advanced features like amortization schedules and graphs, catering to your future financial planning needs.

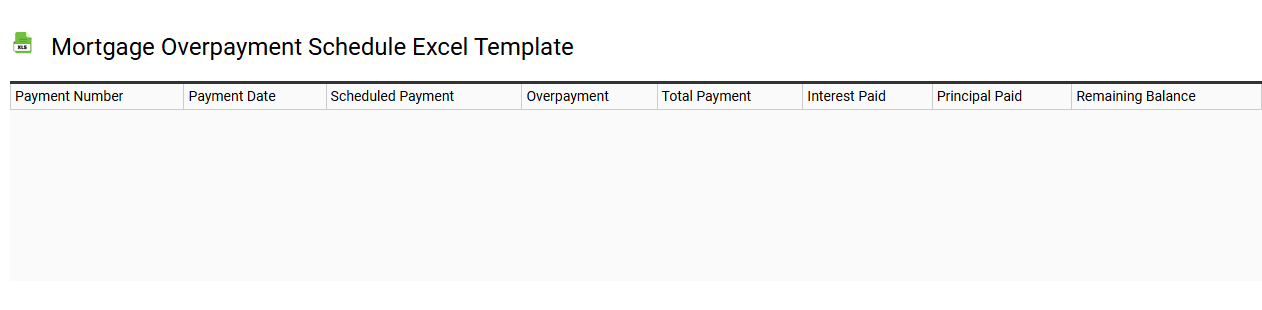

Mortgage overpayment schedule Excel template

💾 Mortgage overpayment schedule Excel template template .xls

A Mortgage overpayment schedule Excel template is a tool designed to help homeowners manage their mortgage payments effectively. This template allows you to input your original mortgage details, such as loan amount, interest rate, term, and any overpayment amounts you plan to make. By calculating the impact of these overpayments on your loan, it provides a visual representation of how much interest you'll save and how early you can pay off the mortgage. This powerful tool can help you achieve potential financial goals, such as reducing debt or reallocating funds into investments, by visualizing both basic overpayment strategies and advanced repayment scenarios.

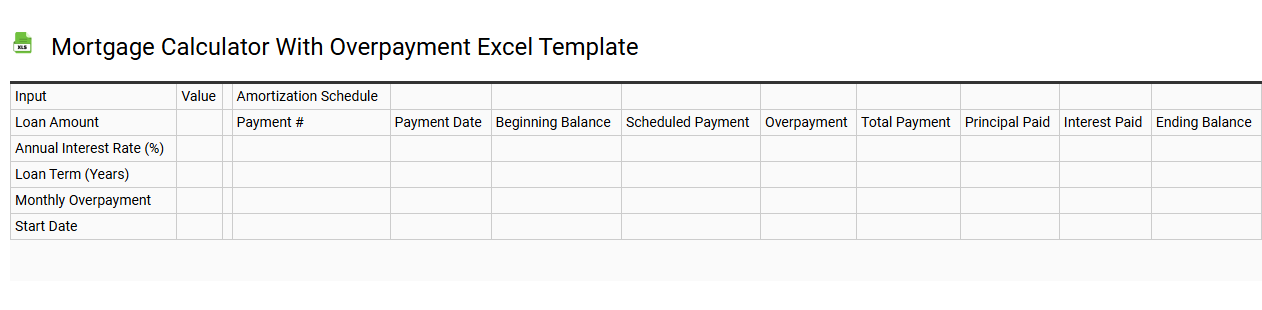

Mortgage calculator with overpayment Excel template

💾 Mortgage calculator with overpayment Excel template template .xls

A mortgage calculator with an overpayment Excel template is a powerful tool designed to help you manage your mortgage efficiently. This template allows you to input key details such as your loan amount, interest rate, loan term, and optional overpayments to see how they affect your mortgage balance and overall payment schedule. You will observe various computations, including total interest savings and the early payoff date, offering insights into your financial decisions. It effectively shows how even small additional payments can significantly reduce the total cost of your mortgage over time while providing an ideal foundation for more advanced financial analysis and forecasting.

UK mortgage overpayment tracker Excel template

![]()

💾 UK mortgage overpayment tracker Excel template template .xls

A UK mortgage overpayment tracker Excel template is a tool designed to help homeowners monitor their mortgage repayments if they choose to pay more than the required monthly amount. This template typically includes fields for your original loan amount, interest rate, monthly payment, and overpayment amounts so you can visualize how extra payments impact your mortgage balance and repayment term. You can customize it to track various scenarios, adjusting overpayment amounts or periods, giving you a clear overview of potential savings on interest payments. This tool can facilitate your financial planning, and further exploration might include advanced analysis features like amortization schedules or tax implications related to overpayments.

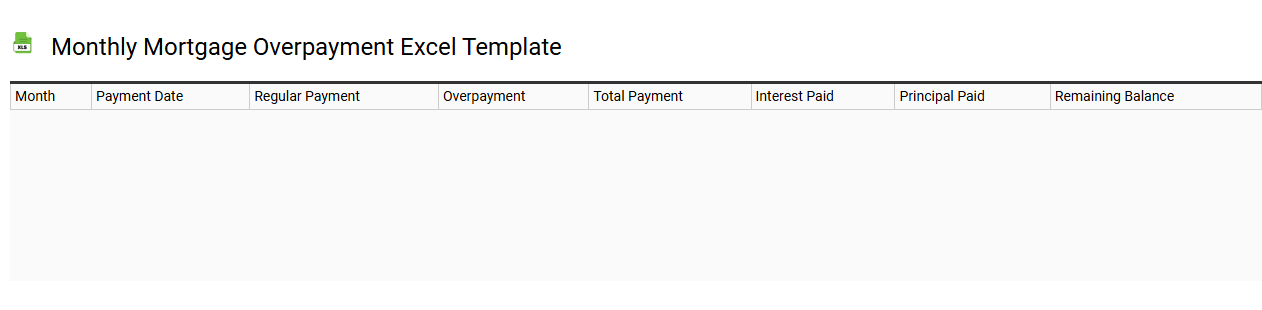

Monthly mortgage overpayment Excel template

💾 Monthly mortgage overpayment Excel template template .xls

A Monthly Mortgage Overpayment Excel template is a structured spreadsheet designed to help you calculate the impact of making extra payments on your mortgage. This tool allows you to input your current loan details, including the principal amount, interest rate, and existing payment schedule. It visually displays how additional payments can reduce the total interest paid over the life of the loan and shorten the repayment period. You can customize it to explore various scenarios, including different overpayment amounts and frequencies, enabling you to make more informed financial decisions regarding your mortgage expenses and long-term savings. Basic usage includes simple overpayment calculations, while further potential needs could involve advanced financial modeling, amortization schedules, and interest rate adjustments.

Mortgage balance tracker Excel template

![]()

💾 Mortgage balance tracker Excel template template .xls

A Mortgage Balance Tracker Excel template helps you monitor the outstanding balance on your mortgage over time. This tool allows you to input details like your initial loan amount, interest rate, and monthly payments, automatically calculating the remaining balance after each payment. You can also visualize your progress through graphs, making it easier to understand how much equity you've built in your home. For basic usage, you can simply track payments; however, potential needs may include advanced features like amortization schedules or the impact of additional principal payments.

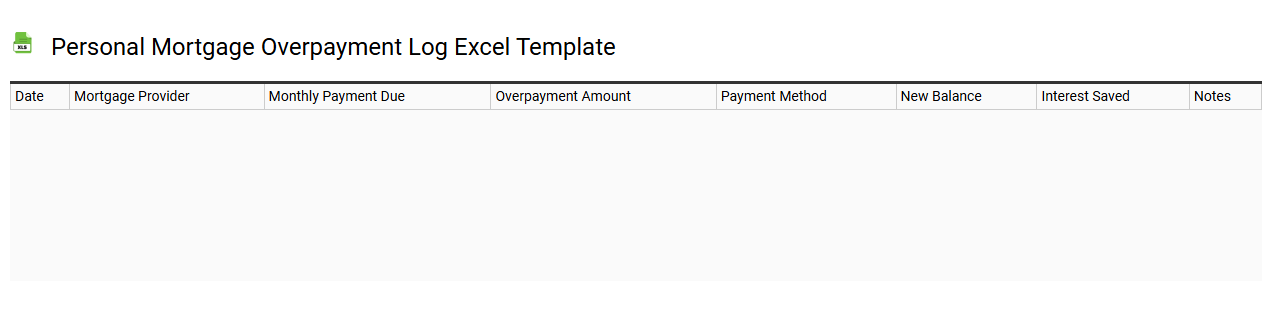

Personal mortgage overpayment log Excel template

💾 Personal mortgage overpayment log Excel template template .xls

A Personal Mortgage Overpayment Log Excel template is a tool designed to help you track and manage your mortgage overpayments efficiently. It typically features columns for payment dates, amounts, and the remaining principal balance, allowing you to visualize how your extra payments reduce the overall interest paid and shorten the loan term. This template can assist you in setting financial goals by demonstrating the impact of additional contributions on your mortgage repayment plan. For enhanced budgeting and financial forecasting, you may consider incorporating advanced functionalities such as amortization schedules and scenario analyses tailored to various overpayment strategies.