Explore a collection of free XLS templates designed specifically for managing your mortgage details. The Mortgage Recap Spreadsheet Excel template simplifies the tracking of your payment history, principal balance, and interest rates over time. With user-friendly layouts and easy-to-fill fields, this tool empowers you to efficiently visualize your mortgage journey while making informed financial decisions.

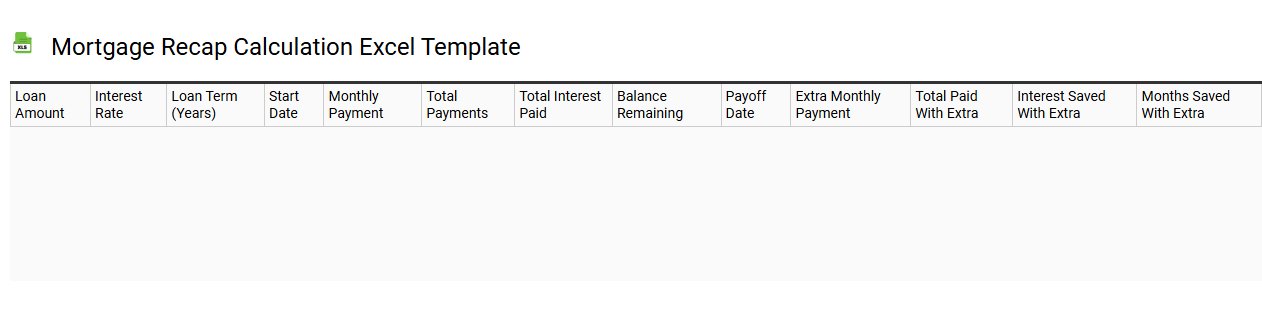

Mortgage recap calculation Excel template

💾 Mortgage recap calculation Excel template template .xls

A Mortgage recap calculation Excel template is a financial tool designed to help users summarize and analyze their mortgage data. It typically includes rows for different entries like principal balance, interest rate, loan term, and monthly payment amounts, allowing you to easily visualize your mortgage's key details. Features might include built-in formulas that automatically calculate total payments, interest paid over the life of the loan, and remaining balances. For basic usage, you can manage monthly payments and track amortization, while further potential needs could incorporate advanced analytics like debt-to-income ratio analyses or refinancing scenarios.

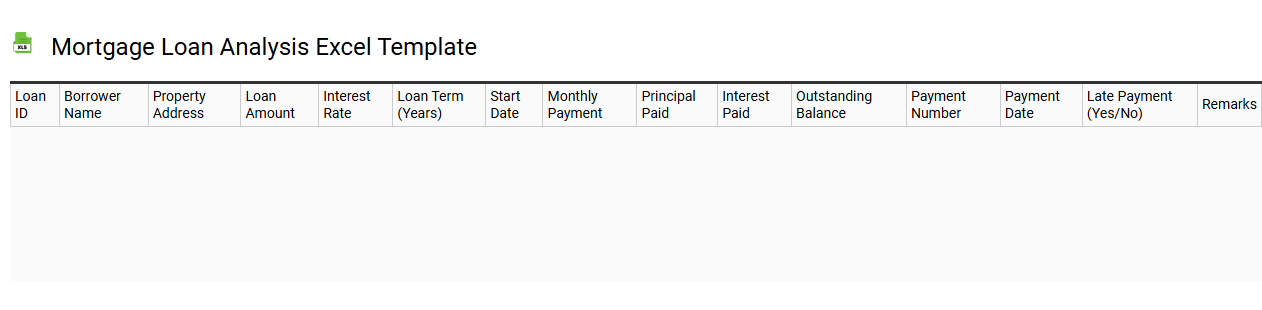

Mortgage loan analysis Excel template

💾 Mortgage loan analysis Excel template template .xls

A Mortgage Loan Analysis Excel template is a structured spreadsheet designed to simplify the evaluation of mortgage loans. This template allows you to input key figures such as loan amount, interest rate, and loan term, automatically calculating monthly payments, total interest paid, and full amortization schedules. You can easily modify variables to see how changes in the interest rate or loan duration affect your payments and overall loan cost. For further potential needs, you might consider incorporating advanced financial modeling features or a sensitivity analysis tool for comprehensive investment assessments.

Mortgage balance tracking Excel template

![]()

💾 Mortgage balance tracking Excel template template .xls

A mortgage balance tracking Excel template is a detailed spreadsheet designed to help homeowners systematically monitor their mortgage payments and outstanding balance over time. This template typically includes columns for payment dates, principal and interest amounts, total payments made, remaining balance, and additional notes. By inputting your payment information, you can easily visualize the reduction of your debt, identify trends in your payment schedule, and gain insights into how extra payments could impact your total interest costs. This tool can evolve to include advanced features such as amortization schedules, variable interest rates, and scenario analysis, offering deeper financial insights for your long-term planning.

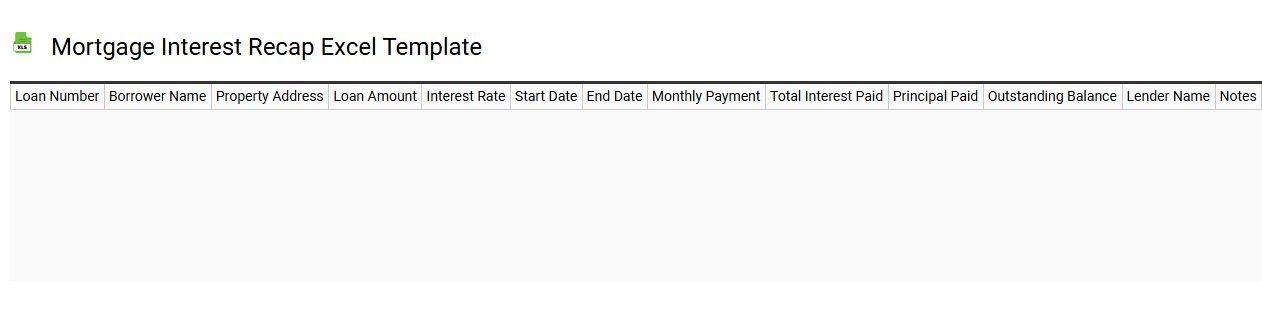

Mortgage interest recap Excel template

💾 Mortgage interest recap Excel template template .xls

A Mortgage Interest Recap Excel template provides a structured way to track and analyze mortgage interest payments over time. This tool typically includes sections for loan details, such as principal balance, interest rate, and payment frequency, making it easy to calculate monthly payments and total interest paid. Users can visualize amortization schedules, compare payment breakdowns, and plan for refinancing or additional payments. While the basic template serves well for personal budgeting, it can be expanded to include advanced analytics like tax implications, equity growth projections, or investment comparisons.

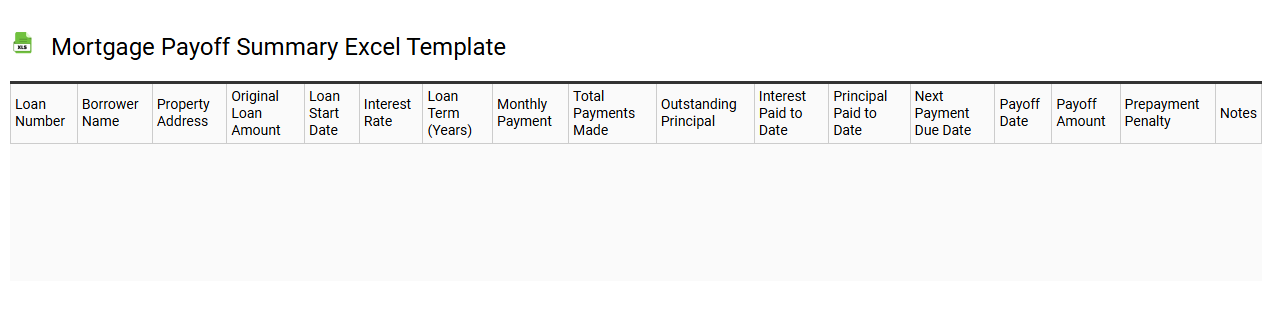

Mortgage payoff summary Excel template

💾 Mortgage payoff summary Excel template template .xls

A Mortgage Payoff Summary Excel template is a powerful tool designed to help homeowners manage and visualize their mortgage repayment journey. This template typically includes essential data such as loan amount, interest rate, monthly payment, remaining balance, and payoff date. Users can easily track their progress over time, calculate savings with extra payments, and assess how different scenarios affect the total cost of the loan. With this tool, you can simplify complex calculations, forecast future payments, and plan for financial goals such as potential refinancing or home equity lending down the line.

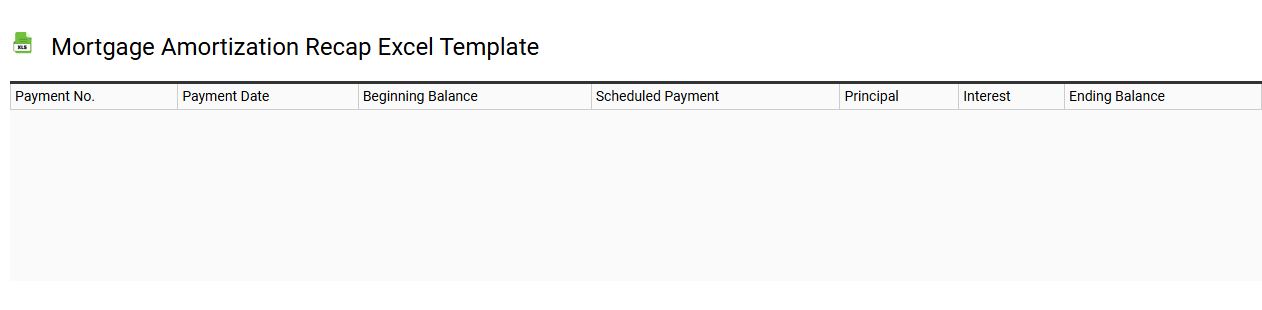

Mortgage amortization recap Excel template

💾 Mortgage amortization recap Excel template template .xls

A Mortgage amortization recap Excel template is a financial tool designed to help you visualize and manage your mortgage payments over time. This template typically includes an amortization schedule that details each payment breakdown, showing how much goes towards the principal versus interest, along with the remaining balance after each payment. You can easily input variables such as loan amount, interest rate, and loan term to generate a customized repayment plan. For further exploration, this template can adapt to incorporate advanced financial metrics like net present value or internal rate of return for more comprehensive analysis.

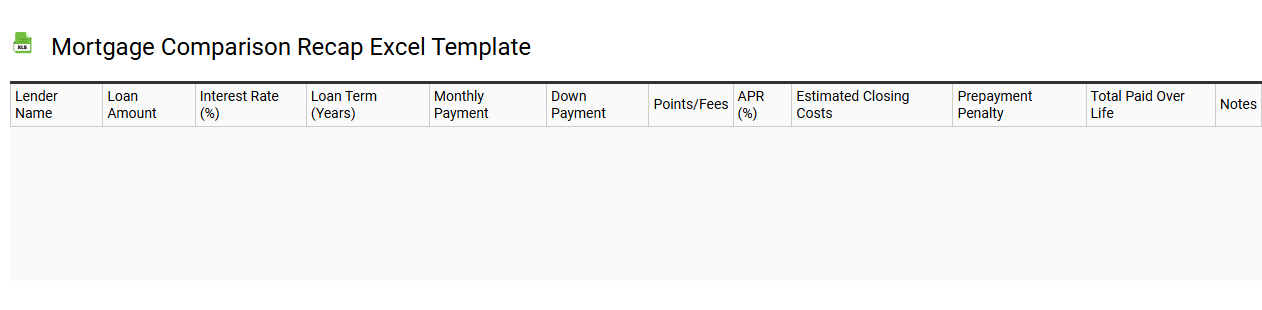

Mortgage comparison recap Excel template

💾 Mortgage comparison recap Excel template template .xls

The Mortgage Comparison Recap Excel template is a tool designed to help you evaluate and compare various mortgage options efficiently. It typically includes essential categories such as loan amount, interest rates, terms, monthly payments, and total interest paid over the life of each mortgage. You can easily input different scenarios to visualize how changes in rates or terms affect your overall cost. This basic template lays a foundation for further analysis, including advanced concepts like amortization schedules, total cost of ownership, or even impact assessments of varying down payment strategies.

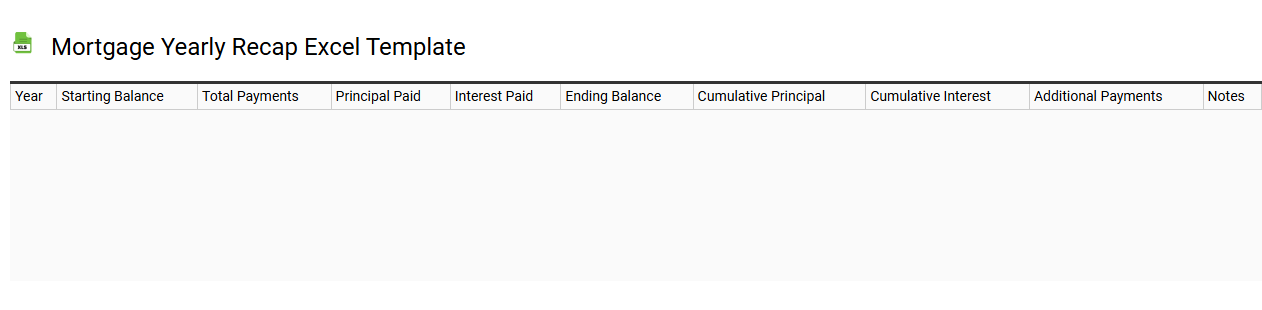

Mortgage yearly recap Excel template

💾 Mortgage yearly recap Excel template template .xls

A Mortgage Yearly Recap Excel template serves as a practical tool for homeowners to track and analyze their mortgage payments over the course of a year. This template typically features detailed sections for monthly payment amounts, principal and interest breakdowns, property taxes, and insurance, allowing for a comprehensive overview of your mortgage expenses. You can easily visualize your payment patterns and see how much equity you've built in your property during the year. Further customization can accommodate advanced calculations, such as amortization schedules and scenarios for potential refinancing.

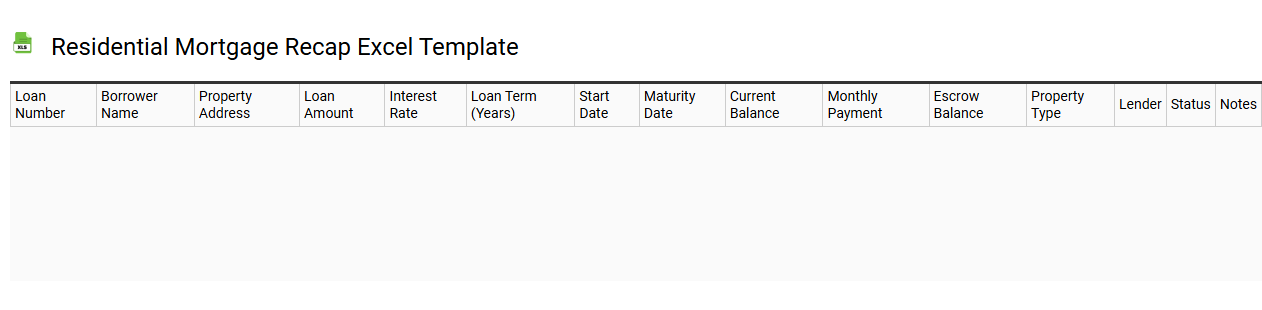

Residential mortgage recap Excel template

💾 Residential mortgage recap Excel template template .xls

A Residential Mortgage Recap Excel template serves as a comprehensive tool for tracking and summarizing mortgage details. This template typically includes sections for loan amounts, interest rates, payment schedules, and property information, allowing you to visualize financial commitments clearly. It may also incorporate fields for monthly payments, remaining balances, and amortization schedules, facilitating better financial planning. For basic usage, you can keep track of your mortgage payments, while advanced options may include sensitivity analysis and detailed scenario modeling for various interest rates and loan terms.