An adjustable-rate mortgage (ARM) Excel template helps you track changes in interest rates and their impact on your monthly payments, giving you clear insights into potential savings or costs over time. Each section allows for inputting principal, initial interest rate, adjustment frequency, and maximum rate adjustments. With this template, you can easily compare the long-term financial implications of choosing between adjustable and fixed-rate mortgages, assisting you in making an informed decision for your financial future.

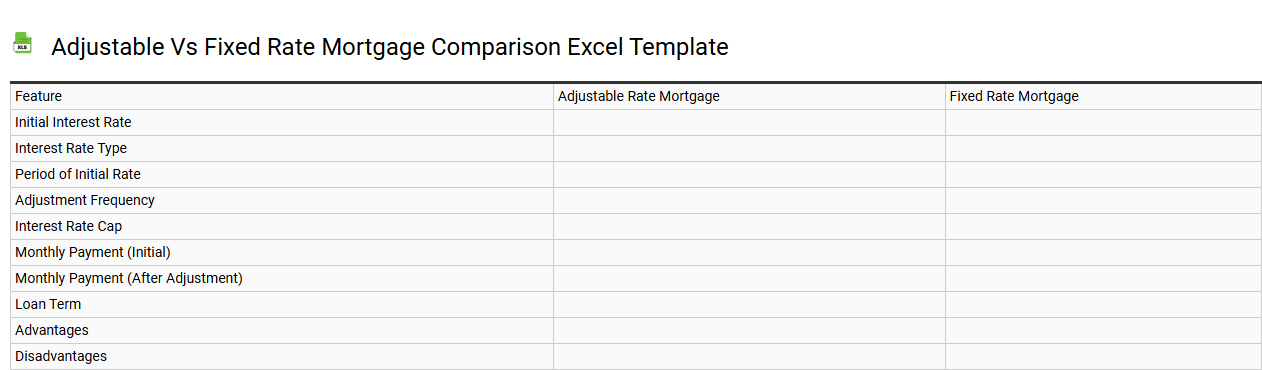

Adjustable vs fixed rate mortgage comparison Excel template

💾 Adjustable vs fixed rate mortgage comparison Excel template template .xls

An Adjustable vs Fixed Rate Mortgage Comparison Excel template provides a clear framework for evaluating the two mortgage options based on various financial metrics. It enables you to input specific loan amounts, interest rates, and loan terms, allowing for direct side-by-side comparisons of total payments and interest paid over time. You can visualize the potential cost fluctuations associated with adjustable-rate mortgages as interest rates change, highlighting key variables impacting your financial decisions. With this template, you can assess your current needs while considering future possibilities such as refinancing or changing economic conditions.

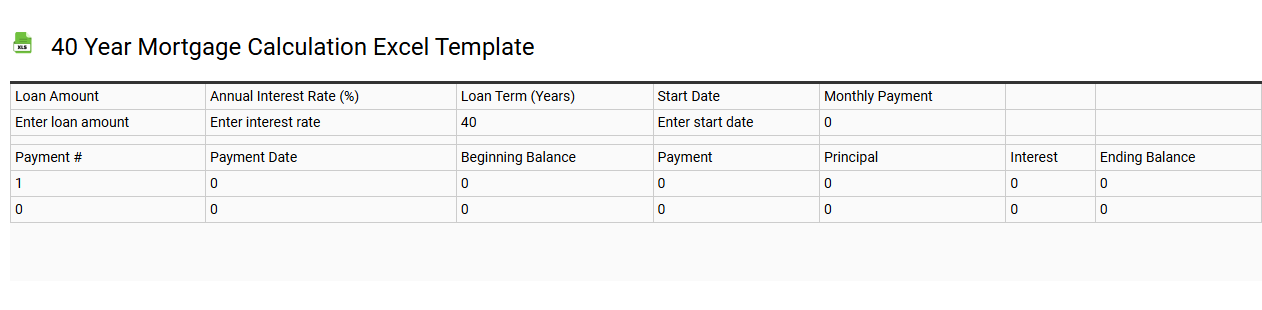

40 year mortgage calculation Excel template

💾 40 year mortgage calculation Excel template template .xls

A 40-year mortgage calculation Excel template allows you to analyze long-term home financing scenarios effectively. This tool typically includes input fields for loan amount, interest rate, and initial payment date, which helps you estimate monthly payments over an extended term. You can visualize your amortization schedule, detailing how interest and principal components change over time. As your understanding of the template grows, you might explore features like advanced interest rate adjustments or prepayment scenarios for a comprehensive financial strategy.

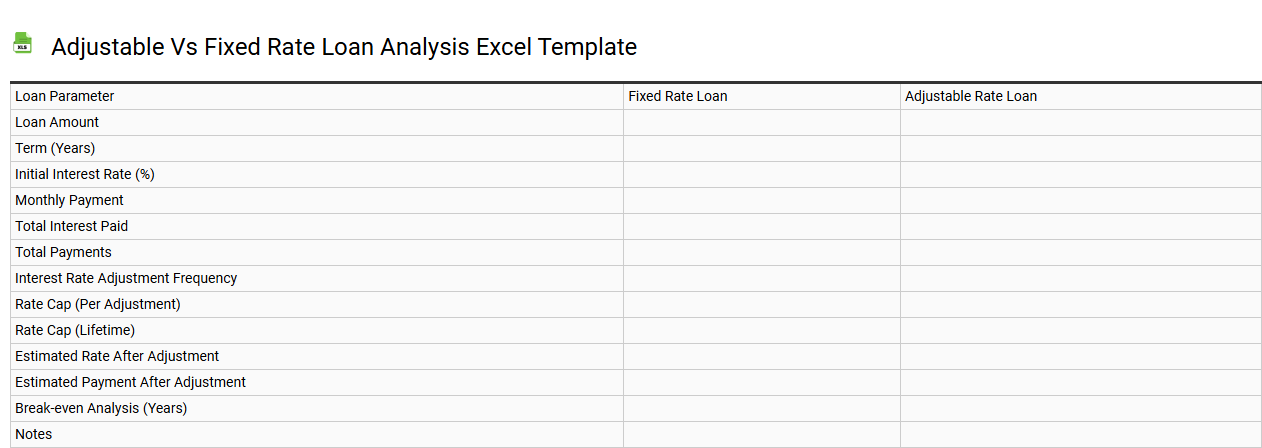

Adjustable vs fixed rate loan analysis Excel template

💾 Adjustable vs fixed rate loan analysis Excel template template .xls

An Adjustable vs Fixed Rate Loan Analysis Excel template provides a comprehensive tool for comparing the financial implications of choosing between adjustable-rate and fixed-rate loans. This template typically contains detailed breakdowns of loan amounts, interest rates, monthly payments, and total interest paid over time. Users can easily input different variables to visualize how interest rate fluctuations or constant rates affect overall costs. The analysis can highlight scenarios such as payment caps, potential rate increases, and refinancing options, catering to basic needs and advanced strategies in interest rate risk management and amortization schedules.

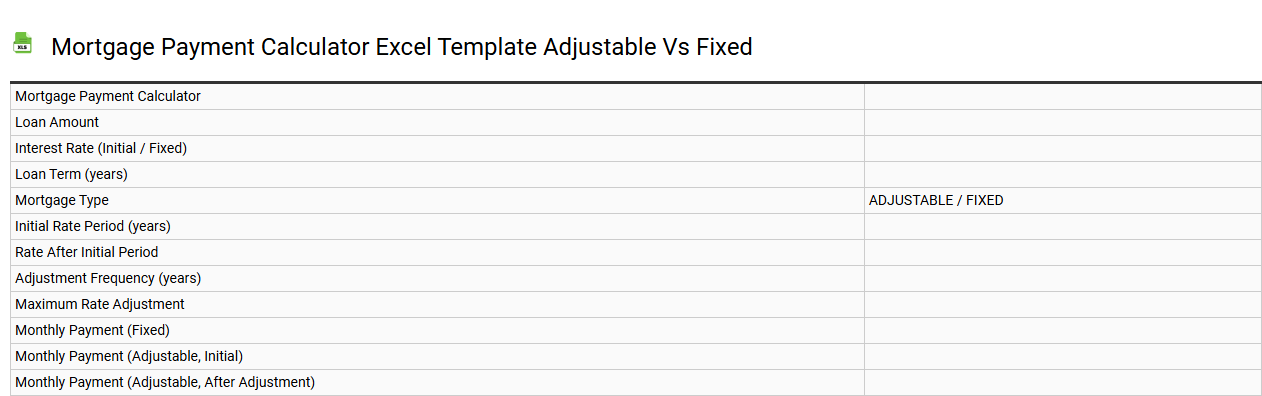

Mortgage payment calculator Excel template adjustable vs fixed

💾 Mortgage payment calculator Excel template adjustable vs fixed template .xls

A mortgage payment calculator Excel template allows you to compute monthly mortgage payments based on adjustable or fixed interest rates. With a fixed-rate mortgage, your monthly payments remain constant throughout the loan term, offering predictability in budgeting. Conversely, an adjustable-rate mortgage may fluctuate after an initial fixed period, potentially leading to varying monthly payments. This template is useful for estimating your payments, tracking amortization schedules, and exploring various scenarios involving principal amount, interest rates, and loan terms, while further exploration could lead you to advanced options like bi-weekly payments or prepayment penalties.

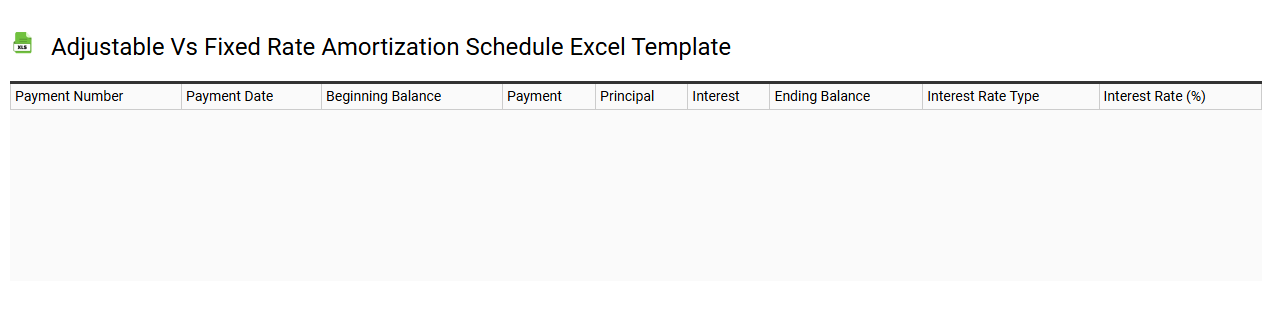

Adjustable vs fixed rate amortization schedule Excel template

💾 Adjustable vs fixed rate amortization schedule Excel template template .xls

An adjustable rate amortization schedule Excel template allows you to calculate mortgage payments that can change over time based on interest rate fluctuations. This template typically includes fields for initial loan amount, interest rates, loan term, and adjustable frequency, providing an easy-to-understand visual of how your payment may vary. On the other hand, a fixed rate amortization schedule ensures that your payments remain constant throughout the loan duration, enhancing predictability in budgeting. For further analysis, advanced features such as sensitivity analysis and scenario modeling can be integrated to evaluate potential impacts of rate changes or refinancing options on your financial strategy.

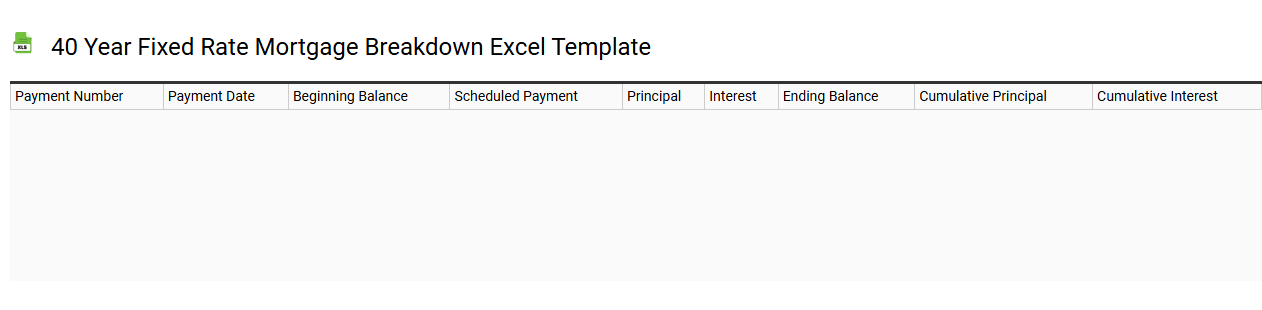

40 year fixed rate mortgage breakdown Excel template

💾 40 year fixed rate mortgage breakdown Excel template template .xls

A 40-year fixed-rate mortgage breakdown Excel template provides a detailed framework for managing and analyzing long-term mortgage payments. Within the template, columns typically include loan amount, interest rate, monthly payments, total interest paid over the life of the loan, and a detailed amortization schedule. You can input various scenarios with adjustable loan amounts and interest rates to visualize how changes affect your monthly budget. This tool is invaluable for tracking payments, understanding interest accrual, and planning for potential financial adjustments related to homeownership. For more advanced needs, consider incorporating features like loan payoff scenarios, tax implications, and custom payment frequencies.

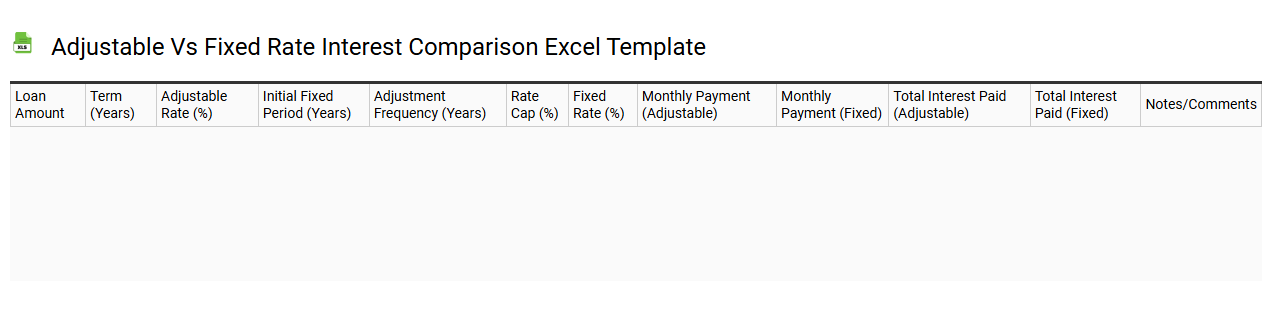

Adjustable vs fixed rate interest comparison Excel template

💾 Adjustable vs fixed rate interest comparison Excel template template .xls

An Adjustable vs Fixed Rate Interest Comparison Excel template allows you to evaluate and contrast the financial implications of fixed and adjustable-rate loans. The template typically includes sections for inputting key variables such as loan amounts, interest rates, and loan terms. You can visualize potential payment timelines and total interest paid over the life of the loan through graphs and tables. Understanding these elements can help you make informed decisions about your financing options and anticipate your future budgeting needs, including the assessments of risk and long-term cost-effectiveness.

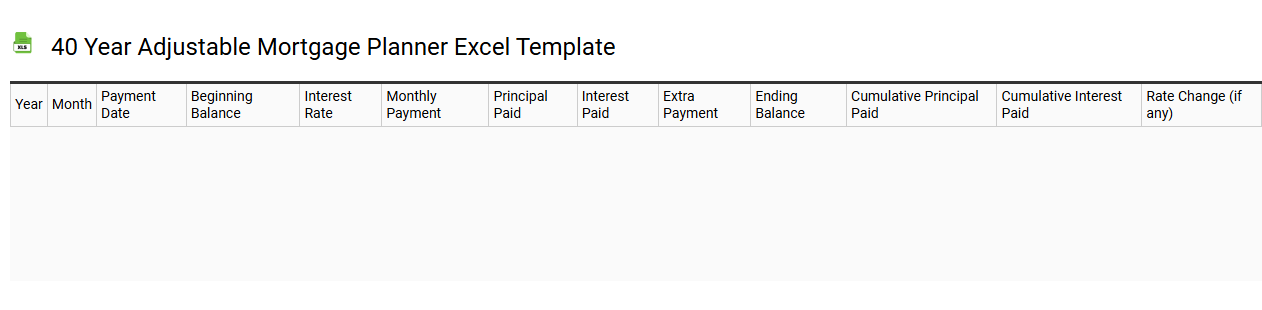

40 year adjustable mortgage planner Excel template

💾 40 year adjustable mortgage planner Excel template template .xls

A 40-year adjustable mortgage planner Excel template is a financial tool designed to help homeowners or prospective buyers analyze the costs and benefits of a long-term adjustable-rate mortgage. This template typically includes fields for inputting data such as loan amount, interest rates, and adjustment periods. You can visualize monthly payments, total interest paid, and how fluctuations in interest rates could impact your financial obligations over time. Utilizing this planner allows you to assess both basic payment structures and more advanced scenarios like refinancing or potential rent fluctuations.

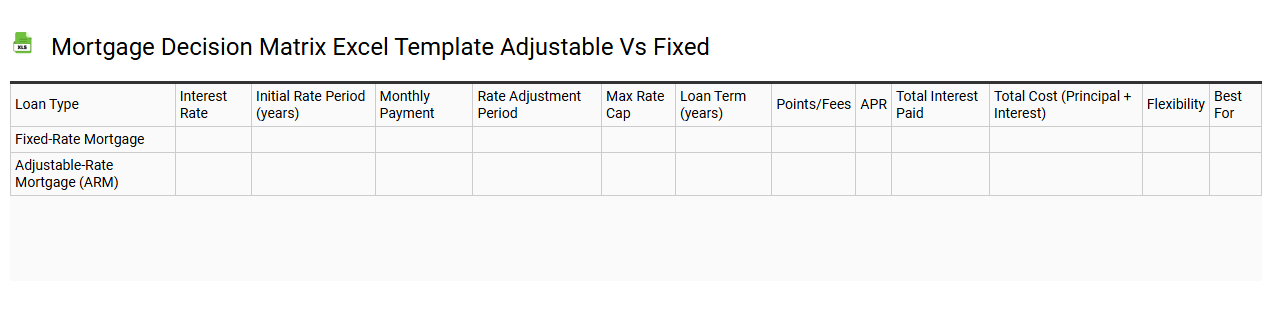

Mortgage decision matrix Excel template adjustable vs fixed

💾 Mortgage decision matrix Excel template adjustable vs fixed template .xls

A Mortgage Decision Matrix Excel template allows you to compare adjustable and fixed-rate mortgage options efficiently. With adjustable-rate mortgages, you see how interest rates can fluctuate over time, impacting your monthly payments and the total interest paid over the lifespan of the loan. The fixed-rate option offers a stable payment structure, giving you predictability and peace of mind against market changes. This template can help you analyze not just current rates but also potential changes in mortgage rates, tax implications, and total cost calculations over different terms, assisting with your informed financial decisions.

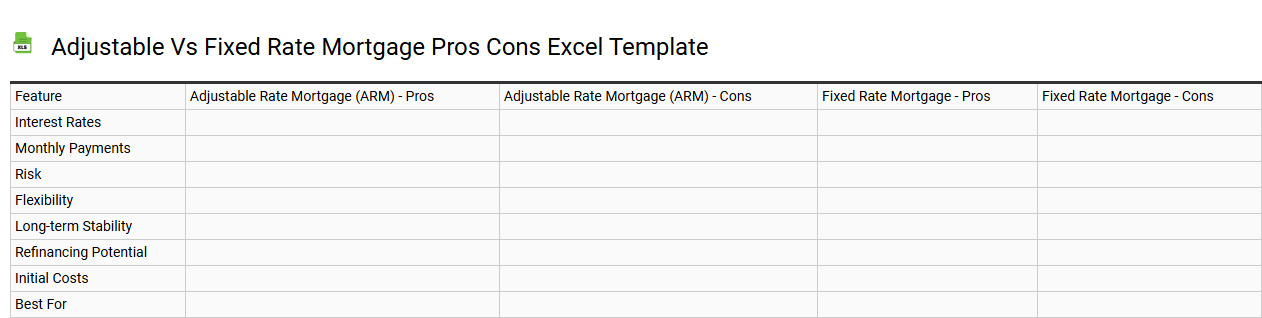

Adjustable vs fixed rate mortgage pros cons Excel template

💾 Adjustable vs fixed rate mortgage pros cons Excel template template .xls

Adjustable-rate mortgages (ARMs) offer lower initial interest rates, making monthly payments more affordable for many borrowers. Over time, these rates can fluctuate based on market conditions, which might lead to significantly higher payments if interest rates rise. Fixed-rate mortgages provide stability and predictability, ensuring that your monthly payments remain constant throughout the loan term, which is useful for budgeting and long-term financial planning. Weighing options, you might consider using an Excel template to analyze potential savings and calculate the impact of interest rate changes on your overall costs, while factoring in advanced concepts like APR, amortization schedules, and refinancing potential.