Discover a range of free XLS templates designed for loan repayment reports that simplify your financial tracking. Each template features organized sections for borrower information, loan amounts, interest rates, and payment schedules, ensuring a clear overview of your repayment obligations. Customize these templates to fit your specific loan details, making it easy to monitor progress and plan for upcoming payments in an efficient manner.

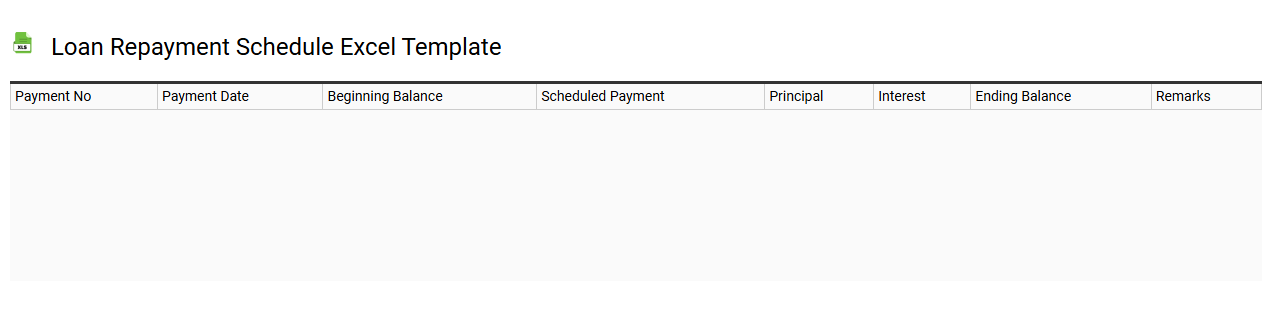

Loan repayment schedule Excel template

💾 Loan repayment schedule Excel template template .xls

A Loan repayment schedule Excel template serves as an organized tool to track and manage loan repayments. This template typically includes essential data such as loan amount, interest rate, repayment period, and monthly payment amounts. As payments are made, it allows for real-time updates, showing remaining balance, interest paid, and principal paid in a clear format. This resource can be incredibly useful for individuals or businesses looking to understand their cash flow, budget accordingly, and analyze potential refinancing options or early repayment strategies.

Loan payment tracker Excel template

![]()

💾 Loan payment tracker Excel template template .xls

A Loan Payment Tracker Excel template allows you to efficiently manage and monitor your loan payments. This customizable spreadsheet organizes key details such as loan amounts, interest rates, payment schedules, and remaining balances. You can easily input your payment dates and amounts, which helps you visualize upcoming obligations and track your financial progress. This tool can assist you in avoiding late fees and planning for future financial needs, from simple budgeting to complex amortization calculations or refinancing scenarios.

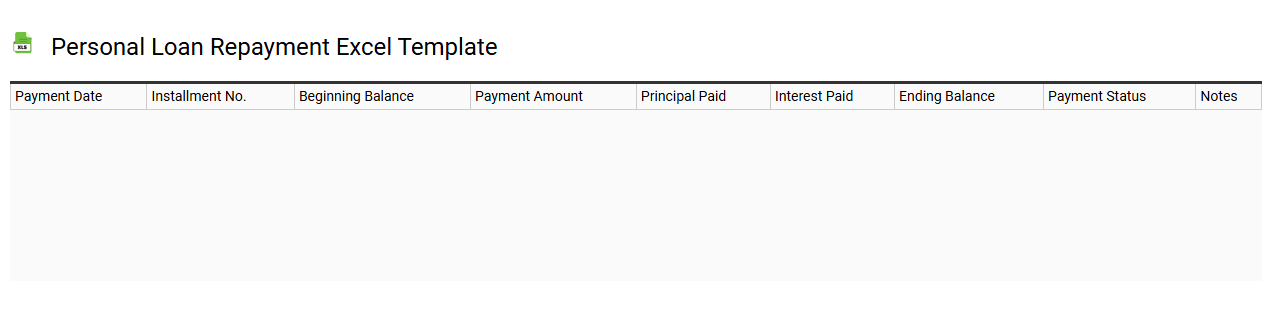

Personal loan repayment Excel template

💾 Personal loan repayment Excel template template .xls

A Personal loan repayment Excel template is a structured spreadsheet designed to help you manage and track your personal loan repayments efficiently. It typically includes key features such as loan amount, interest rate, repayment schedule, and remaining balance, allowing for clear visibility of your payment progress. Users can input their loan details, and the template automatically calculates monthly payments and total interest paid over time. This tool can be essential for effective budgeting and financial planning, while advanced users might integrate complex formulas or charts to analyze long-term financial impacts.

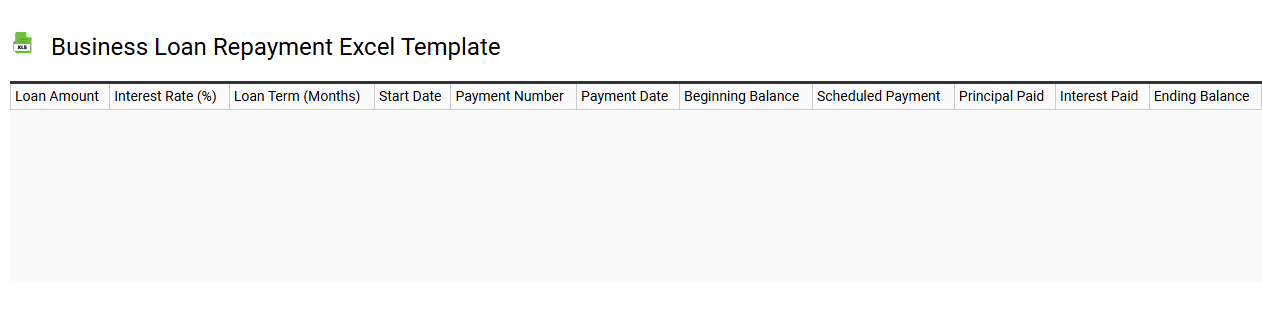

Business loan repayment Excel template

💾 Business loan repayment Excel template template .xls

A Business loan repayment Excel template is a structured spreadsheet designed to help businesses track and manage their loan payments effectively. This template typically includes fields for loan amount, interest rate, loan term, payment schedule, and total repayment amounts. Each payment entry can be broken down to show principal and interest components, providing clarity on how much of the loan is being reduced over time. You can customize the template according to your specific loan agreements, ensuring it meets your financial tracking needs, and it can further assist with cash flow management and budgeting for future expenses.

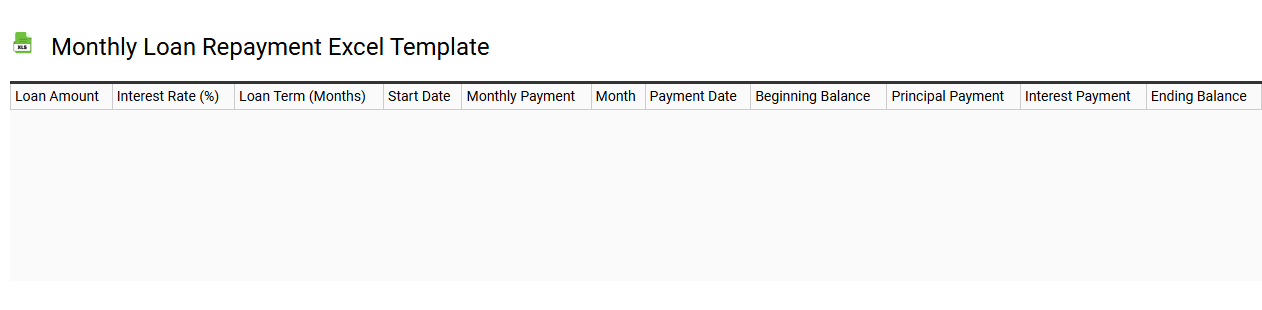

Monthly loan repayment Excel template

💾 Monthly loan repayment Excel template template .xls

A Monthly Loan Repayment Excel template is a structured workbook designed to help individuals and businesses calculate their monthly loan payments easily. Users can input key data, including loan amount, interest rate, term length, and payment frequency to generate an amortization schedule. This schedule breaks down each payment into principal and interest components, providing clear insight into how much you will owe over time. With the ability to adjust parameters, you can simulate various scenarios, including prepayment options and different interest rates, enhancing your financial planning capabilities.

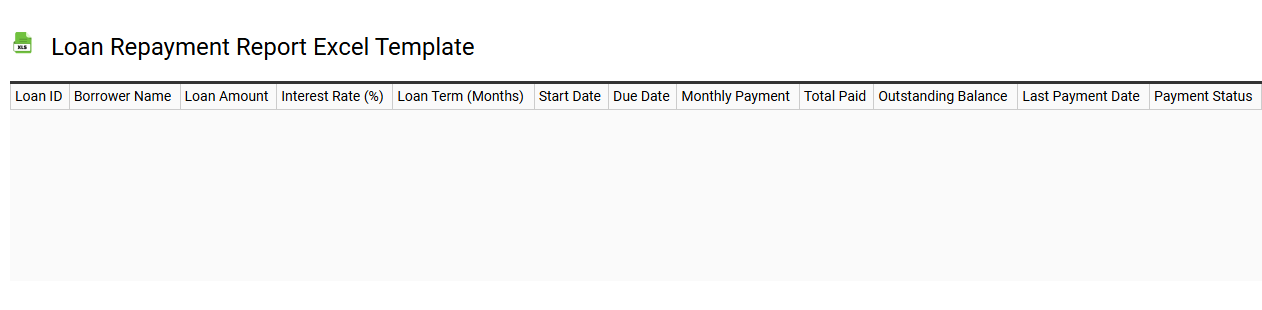

Loan repayment report Excel template

💾 Loan repayment report Excel template template .xls

A Loan Repayment Report Excel template is a structured spreadsheet designed to track and manage loan repayments. It typically includes essential columns such as loan amount, interest rate, monthly payment, due dates, and remaining balance. Users can input relevant data to generate detailed summaries, enabling clear visualization of payment history and outstanding payments. This tool can be beneficial for personal finance management or for businesses monitoring loans for projects or acquisitions, with further potential to analyze cash flows and perform financial forecasting using advanced features like pivot tables and complex formulas.

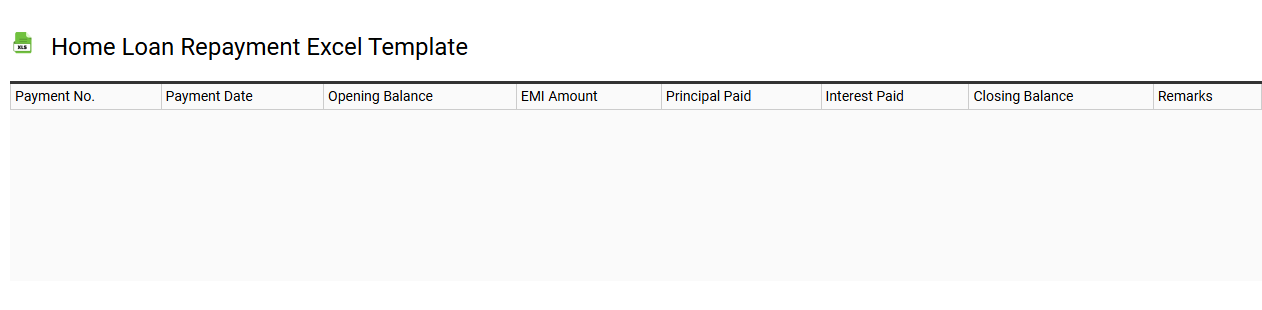

Home loan repayment Excel template

💾 Home loan repayment Excel template template .xls

A Home Loan Repayment Excel template is a structured spreadsheet designed to help individuals track and manage their home loan payments effectively. It typically includes essential details such as loan amount, interest rates, repayment terms, and monthly payment schedules. Users can input their specific loan parameters to visualize amortization, showing how much of each payment goes toward principal and interest over time. This template can assist you in planning for additional payments or refinancing options, while professionals might delve into concepts like loan amortization schedules and interest rate derivations for advanced financial analysis.

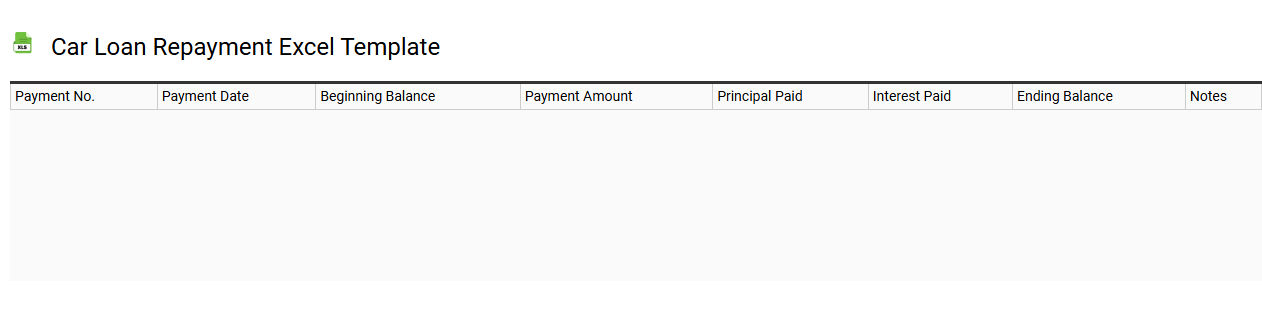

Car loan repayment Excel template

💾 Car loan repayment Excel template template .xls

A car loan repayment Excel template helps you track your loan payments, interest rates, and remaining balances efficiently. It typically features sections for inputting loan amount, interest rate, and loan term, enabling you to calculate monthly payments automatically. Users can visualize their repayment progress through charts and tables, making it easier to manage finances. Start with basic loan tracking, then consider integrating advanced functions like amortization schedules or cash flow forecasting for deeper insights.

Loan installment tracker Excel template

![]()

💾 Loan installment tracker Excel template template .xls

A Loan Installment Tracker Excel template is designed to help you monitor and manage your loan payments effectively. This spreadsheet includes sections for recording loan details, payment amounts, due dates, and outstanding balances. You can visualize your payment history and upcoming due dates with built-in formulas and charts for easy tracking. Using this template, you can stay organized while managing your debts and assess your financial health, ensuring you meet future payment obligations or consider refinancing options, amortization schedules, or interest rate adjustments.