Explore a range of free XLS templates designed specifically for mortgage lump sum payments. These templates simplify the process of calculating how additional payments affect your mortgage balance, enabling you to visualize potential savings over time. Each template includes user-friendly fields for entering your mortgage details and extra payment amounts, ensuring you can easily track your financial progress.

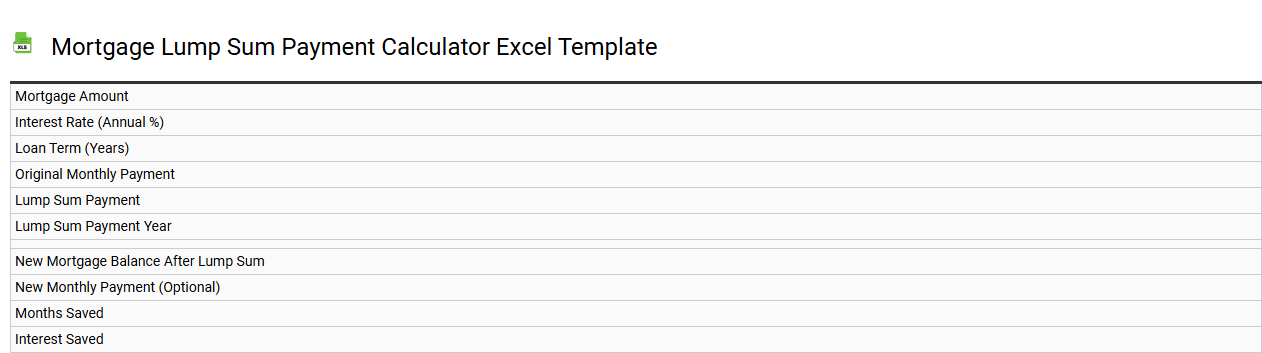

Mortgage lump sum payment calculator Excel template

💾 Mortgage lump sum payment calculator Excel template template .xls

A Mortgage Lump Sum Payment Calculator Excel template is a tool designed to help you analyze the impact of making a one-time extra payment on your mortgage. This template allows you to input details such as your current mortgage balance, interest rate, and the proposed lump sum payment amount. It calculates the potential savings on interest costs and reductions in loan term, providing a clear picture of how this payment can accelerate your mortgage payoff. You can use this tool to plan for basic extra payments while also exploring more advanced financial strategies like refinancing or loan restructuring.

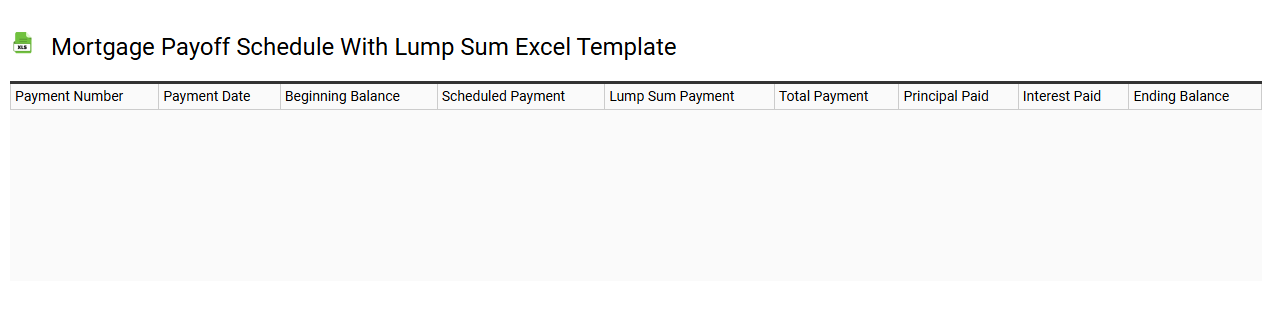

Mortgage payoff schedule with lump sum Excel template

💾 Mortgage payoff schedule with lump sum Excel template template .xls

A mortgage payoff schedule with a lump sum Excel template provides a structured way to visualize your mortgage repayment over time. This tool allows you to input details such as loan amount, interest rate, payment frequency, and any additional lump sum payments you plan to make. As you enter your data, the template calculates the remaining balance and total interest paid over the loan term, reflecting the impact of extra payments on your overall mortgage. You can analyze your repayment strategy further, exploring advanced concepts like amortization schedules, principal reduction, and the long-term savings achieved by making prepayments.

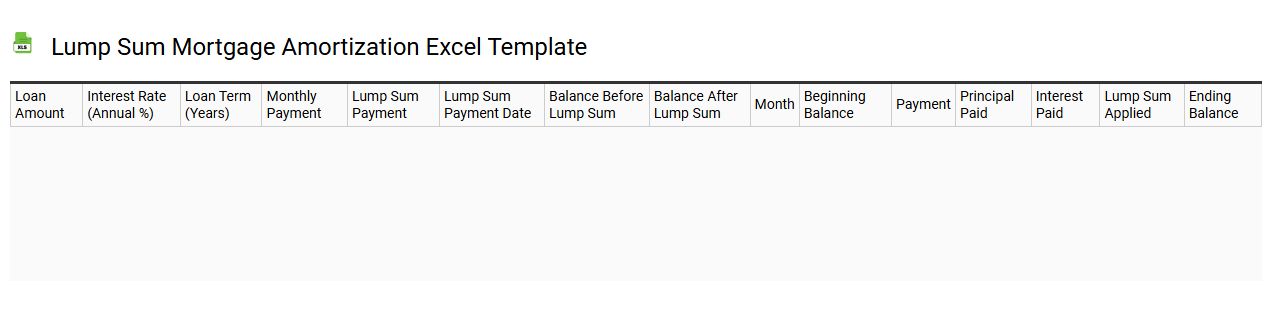

Lump sum mortgage amortization Excel template

💾 Lump sum mortgage amortization Excel template template .xls

A lump sum mortgage amortization Excel template provides a streamlined way to calculate the repayment schedule for a mortgage with a lump sum payment applied at specified intervals. Users can input the principal amount, interest rate, term length, and any scheduled lump sum payments to generate an amortization table that details each monthly payment, interest paid, and remaining balance over time. This tool helps visualize how extra payments can significantly reduce the total interest paid and shorten the loan term, enhancing financial planning. Basic usage includes tracking regular payments and lump sum applications, while advanced features may involve varying interest rates or additional loan types, enabling deeper financial analysis.

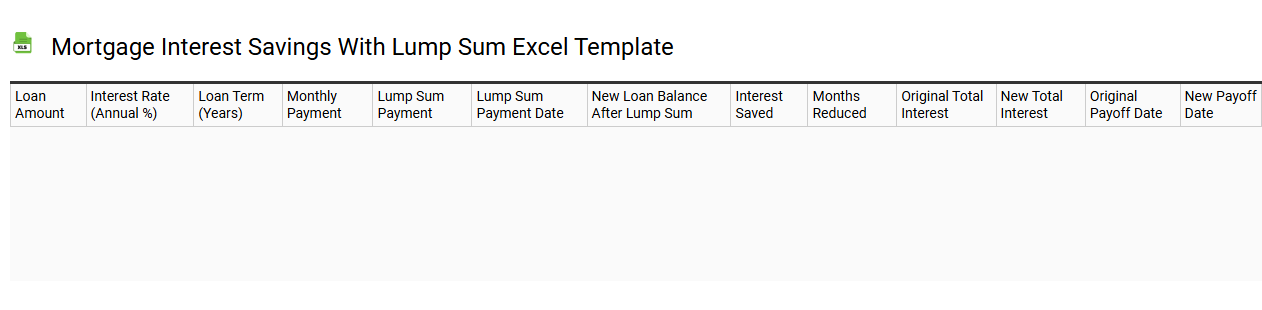

Mortgage interest savings with lump sum Excel template

💾 Mortgage interest savings with lump sum Excel template template .xls

Mortgage interest savings with a lump sum Excel template allows you to visualize the financial impact of making additional payments towards your mortgage. You input your current mortgage details, including the principal amount, interest rate, and remaining term, alongside the desired lump sum payment. The template calculates the interest savings and potential reduction in loan duration, providing clear insights into how these payments can expedite your path to mortgage freedom. This tool is invaluable for homeowners aiming to optimize their budget while considering advanced metrics like amortization schedules and comparing loan options.

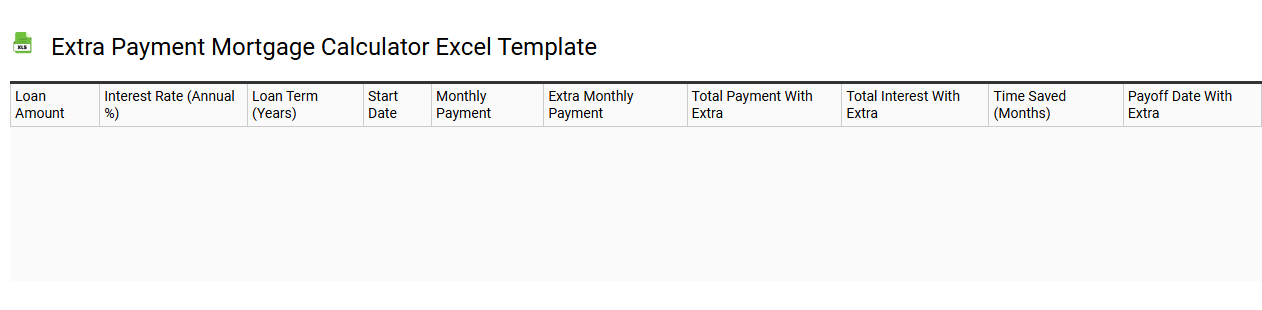

Extra payment mortgage calculator Excel template

💾 Extra payment mortgage calculator Excel template template .xls

An Extra Payment Mortgage Calculator Excel template helps you analyze the impact of additional payments on your mortgage. This tool calculates how extra contributions towards your principal can reduce the total interest paid and shorten the loan term. With a user-friendly interface, you can input variables like loan amount, interest rate, duration, and desired extra payment amount. It serves basic budgeting needs while offering advanced features for amortization schedules, interest savings projections, and visual graphs for a comprehensive financial plan.

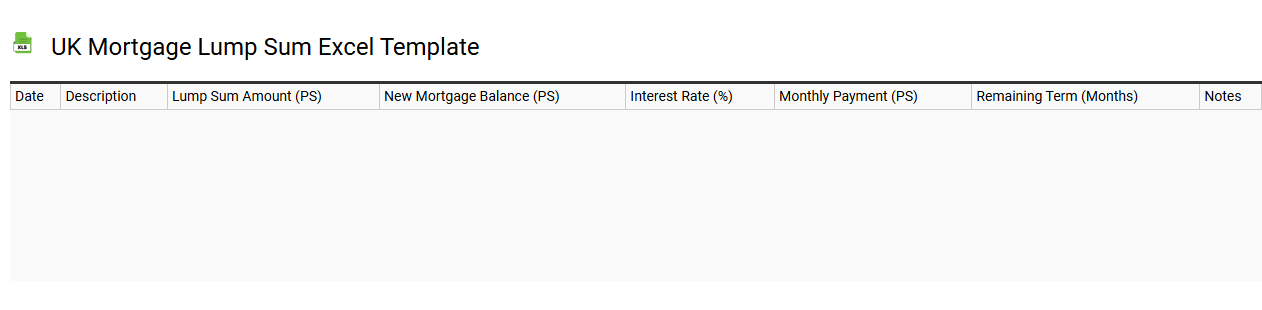

UK mortgage lump sum Excel template

💾 UK mortgage lump sum Excel template template .xls

A UK mortgage lump sum Excel template is a spreadsheet designed to help homeowners manage and analyze their mortgage payments and lump sum repayments effectively. This tool typically includes fields for inputting details such as the original mortgage amount, interest rate, loan term, and any lump sum payments made. You can visualize the impact of these lump sum contributions on your overall mortgage balance and interest payable over time. This template can assist in optimizing your repayment strategy, whether for basic tracking or advanced financial planning, such as calculating amortization schedules and evaluating refinancing options.

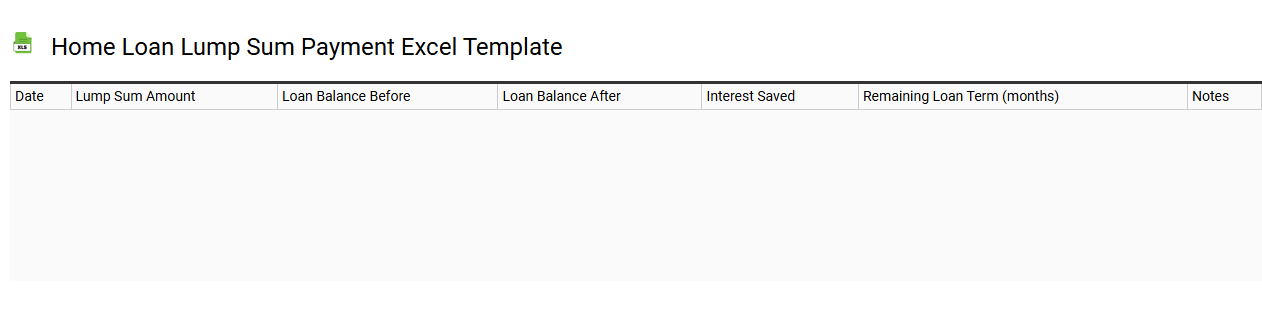

Home loan lump sum payment Excel template

💾 Home loan lump sum payment Excel template template .xls

A Home Loan Lump Sum Payment Excel template is a specialized tool designed to help homeowners and prospective borrowers visualize and manage their mortgage payments efficiently. You can input essential details such as loan amount, interest rate, and loan term to calculate monthly payments and the impact of making lump sum payments at different points in your mortgage lifecycle. The template often includes features such as amortization schedules, which detail principal and interest breakdown over time, and a graph to illustrate the reduction of the loan balance. This financial tool can assist you in strategizing your payments, considering basic usage for prepayments and advanced scenarios like refinancing or investment planning.

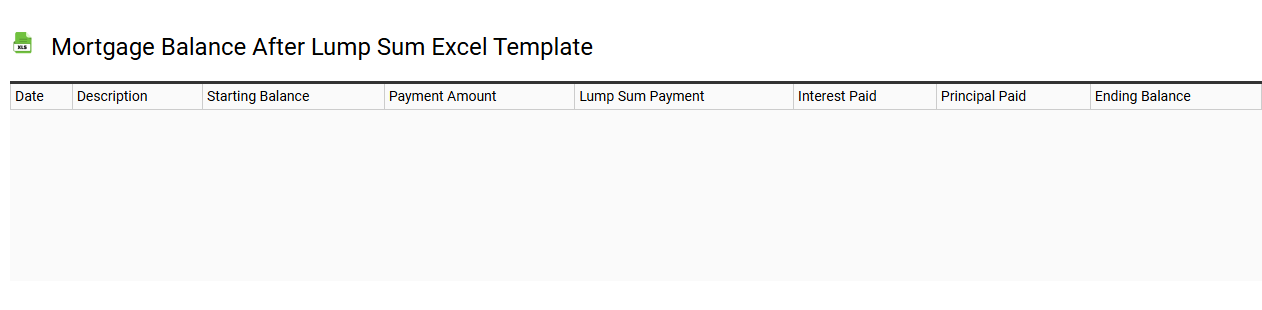

Mortgage balance after lump sum Excel template

💾 Mortgage balance after lump sum Excel template template .xls

A mortgage balance after a lump sum Excel template allows homeowners to efficiently calculate their remaining mortgage balance following an extra payment. This template includes fields for the original loan amount, interest rate, loan term, and details regarding the lump sum payment. You enter your current mortgage balance and the date of the lump sum payment, clearly seeing how this one-time contribution affects your overall debt. Beyond basic usage, you can extend this tool to explore complex amortization schedules or analyze the impact of varying interest rates on long-term savings.